Stacc SMB Lending

Automated where it matters. Human where it counts.

Stacc SMB Lending is a cloud-native, modular loan origination and servicing platform built for Nordic banks that want to scale small and medium-sized business lending.

Automate high-volume tasks, standardise credit decisions and empower advisors with advanced financial analysis – all in one integrated platform from application intake to disbursement and beyond.

Stacc SMB Lending

Automated where it matters. Human where it counts.

Stacc SMB Lending is a cloud-native, modular loan origination and servicing platform built for Nordic banks that want to scale small and medium-sized business lending.

Automate high-volume tasks, standardise credit decisions and empower advisors with advanced financial analysis – all in one integrated platform from application intake to disbursement and beyond.

Stacc SMB Lending

Automated where it matters. Human where it counts.

Stacc SMB Lending is a cloud-native, modular loan origination and servicing platform built for Nordic banks that want to scale small and medium-sized business lending.

Automate high-volume tasks, standardise credit decisions and empower advisors with advanced financial analysis – all in one integrated platform from application intake to disbursement and beyond.

Impact that speaks for itself

Impact that speaks for itself

80%

of customers originated in <1 minute

80%

of customers originated in <1 minute

80%

of customers originated in <1 minute

100%

automation support with advanced collaterals management

100%

automation support with advanced collaterals management

100%

automation support with advanced collaterals management

80%

reduced inquiries to customer support centre

80%

reduced inquiries to customer support centre

80%

reduced inquiries to customer support centre

90%

reduced manual effort in payout controls

90%

reduced manual effort in payout controls

90%

reduced manual effort in payout controls

Overview

Both automation and advanced commercial underwriting

The ultimate combination for SMB lenders

Overview

Both automation and advanced commercial underwriting

The ultimate combination for SMB lenders

Overview

Both automation and advanced commercial underwriting

The ultimate combination for SMB lenders

Automating a high share of tasks across all process steps of commercial lending cases

Application intake

Automatic credit score

Credit decision & proposal

Document production, signing and colleral & covenant registration

Disburse and transfer to core

Loan

servicing

Loan servicing

Deviation management

Commercial Underwriting

Only tasks that need manual handling are assigned to advisors

How we create impact

Stacc combines efficiency and scalability with Nordic flexibility

We help SMB lenders improve Cost/Income ratios - and gain market share

How we create impact

Stacc combines efficiency and scalability with Nordic flexibility

We help SMB lenders improve Cost/Income ratios - and gain market share

How we create impact

Stacc combines efficiency and scalability with Nordic flexibility

We help SMB lenders improve Cost/Income ratios - and gain market share

Why Stacc SMB Lending

Next-generation, Nordic SMB lending with Stacc

Cloud-native credit platform

Our platform is purpose-built for high credit automation and advanced underwriting. It is a cloud-native, API-first and modular architecture covering the full credit lifecycle from application intake to payout and beyond.

Developed and refined over almost a decade in Nordic production, Stacc SMB Lending includes a market-leading collateral module, real-time liquidity, advanced commercial underwriting, embedded decisioning and intelligence.

Innovative company

Superior Time-to-Value

Native compliance and security

Cloud-native credit platform

Our platform is purpose-built for high credit automation and advanced underwriting. It is a cloud-native, API-first and modular architecture covering the full credit lifecycle from application intake to payout and beyond.

Developed and refined over almost a decade in Nordic production, Stacc SMB Lending includes a market-leading collateral module, real-time liquidity, advanced commercial underwriting, embedded decisioning and intelligence.

Innovative company

Superior Time-to-Value

Native compliance and security

Cloud-native credit platform

Our platform is purpose-built for high credit automation and advanced underwriting. It is a cloud-native, API-first and modular architecture covering the full credit lifecycle from application intake to payout and beyond.

Developed and refined over almost a decade in Nordic production, Stacc SMB Lending includes a market-leading collateral module, real-time liquidity, advanced commercial underwriting, embedded decisioning and intelligence.

Innovative company

Superior Time-to-Value

Native compliance and security

Customer stories

Don't just listen to us

Explore customers' own accounts of how Stacc is transforming SMB lending.

Customer stories

Don't just listen to us

Explore customers' own accounts of how Stacc is transforming SMB lending.

Customer stories

Don't just listen to us

Explore customers' own accounts of how Stacc is transforming SMB lending.

Always useful to meet at the user forum

Stacc SMB Lending customer

Always useful to meet at the user forum

Stacc SMB Lending customer

Always useful to meet at the user forum

Stacc SMB Lending customer

We look forward to using the new analysis tool where the collection of financial statements, generation of analyses, and forecasts occur automatically. This streamlines our workflow and enables us to provide even better advice to our business customers.

Stacc SMB Lending customer

We look forward to using the new analysis tool where the collection of financial statements, generation of analyses, and forecasts occur automatically. This streamlines our workflow and enables us to provide even better advice to our business customers.

Stacc SMB Lending customer

We look forward to using the new analysis tool where the collection of financial statements, generation of analyses, and forecasts occur automatically. This streamlines our workflow and enables us to provide even better advice to our business customers.

Stacc SMB Lending customer

We are super happy with the team we have assigned to us.

Stacc SMB Lending customer

We are super happy with the team we have assigned to us.

Stacc SMB Lending customer

We are super happy with the team we have assigned to us.

Stacc SMB Lending customer

Reduced manual handling of B2B customers being onboarded. Paper trail for onboarded B2C credit customers. Rapid alerts if services are down. And more...

Stacc SMB Lending customer

Reduced manual handling of B2B customers being onboarded. Paper trail for onboarded B2C credit customers. Rapid alerts if services are down. And more...

Stacc SMB Lending customer

Reduced manual handling of B2B customers being onboarded. Paper trail for onboarded B2C credit customers. Rapid alerts if services are down. And more...

Stacc SMB Lending customer

Business development and understanding is good for everyone on our customer team. The service level is high and collaboration is very good. The team also has good domain competence on banking and financial services.

Stacc SMB Lending customer

Business development and understanding is good for everyone on our customer team. The service level is high and collaboration is very good. The team also has good domain competence on banking and financial services.

Stacc SMB Lending customer

Business development and understanding is good for everyone on our customer team. The service level is high and collaboration is very good. The team also has good domain competence on banking and financial services.

Stacc SMB Lending customer

Collaboration and flexibility of the solution

Stacc SMB Lending customer

Collaboration and flexibility of the solution

Stacc SMB Lending customer

Collaboration and flexibility of the solution

Stacc SMB Lending customer

One of the most significant impacts so far is that they have initiated our digital journey within the corporate market

Stacc SMB Lending customer

One of the most significant impacts so far is that they have initiated our digital journey within the corporate market

Stacc SMB Lending customer

One of the most significant impacts so far is that they have initiated our digital journey within the corporate market

Stacc SMB Lending customer

Good discussions with business developers at Stacc

Stacc SMB Lending customer

Good discussions with business developers at Stacc

Stacc SMB Lending customer

Good discussions with business developers at Stacc

Stacc SMB Lending customer

Better decision support and SMB borrower analysis tools than we had before

Stacc SMB Lending customer

Better decision support and SMB borrower analysis tools than we had before

Stacc SMB Lending customer

Better decision support and SMB borrower analysis tools than we had before

Stacc SMB Lending customer

I wish all suppliers would work with us the way you do

Stacc SMB Lending customer

I wish all suppliers would work with us the way you do

Stacc SMB Lending customer

I wish all suppliers would work with us the way you do

Stacc SMB Lending customer

Solid tool making our advisors more effective

Stacc SMB Lending customer

Solid tool making our advisors more effective

Stacc SMB Lending customer

Solid tool making our advisors more effective

Stacc SMB Lending customer

Always useful to meet at the user forum

Stacc SMB Lending customer

Always useful to meet at the user forum

Stacc SMB Lending customer

We look forward to using the new analysis tool where the collection of financial statements, generation of analyses, and forecasts occur automatically. This streamlines our workflow and enables us to provide even better advice to our business customers.

Stacc SMB Lending customer

We look forward to using the new analysis tool where the collection of financial statements, generation of analyses, and forecasts occur automatically. This streamlines our workflow and enables us to provide even better advice to our business customers.

Stacc SMB Lending customer

We are super happy with the team we have assigned to us.

Stacc SMB Lending customer

We are super happy with the team we have assigned to us.

Stacc SMB Lending customer

Reduced manual handling of B2B customers being onboarded. Paper trail for onboarded B2C credit customers. Rapid alerts if services are down. And more...

Stacc SMB Lending customer

Reduced manual handling of B2B customers being onboarded. Paper trail for onboarded B2C credit customers. Rapid alerts if services are down. And more...

Stacc SMB Lending customer

Business development and understanding is good for everyone on our customer team. The service level is high and collaboration is very good. The team also has good domain competence on banking and financial services.

Stacc SMB Lending customer

Business development and understanding is good for everyone on our customer team. The service level is high and collaboration is very good. The team also has good domain competence on banking and financial services.

Stacc SMB Lending customer

Collaboration and flexibility of the solution

Stacc SMB Lending customer

Collaboration and flexibility of the solution

Stacc SMB Lending customer

One of the most significant impacts so far is that they have initiated our digital journey within the corporate market

Stacc SMB Lending customer

One of the most significant impacts so far is that they have initiated our digital journey within the corporate market

Stacc SMB Lending customer

Good discussions with business developers at Stacc

Stacc SMB Lending customer

Good discussions with business developers at Stacc

Stacc SMB Lending customer

Better decision support and SMB borrower analysis tools than we had before

Stacc SMB Lending customer

Better decision support and SMB borrower analysis tools than we had before

Stacc SMB Lending customer

I wish all suppliers would work with us the way you do

Stacc SMB Lending customer

I wish all suppliers would work with us the way you do

Stacc SMB Lending customer

Solid tool making our advisors more effective

Stacc SMB Lending customer

Solid tool making our advisors more effective

Stacc SMB Lending customer

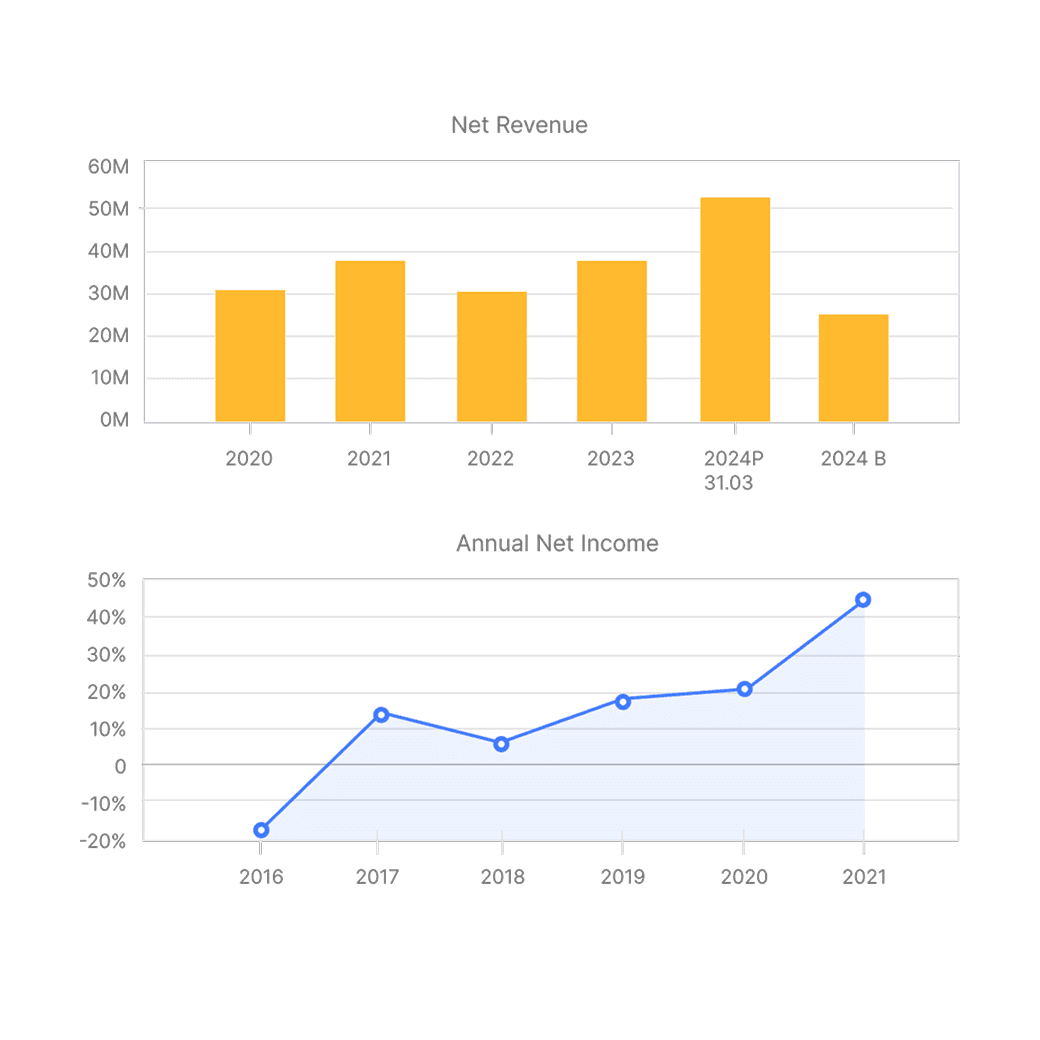

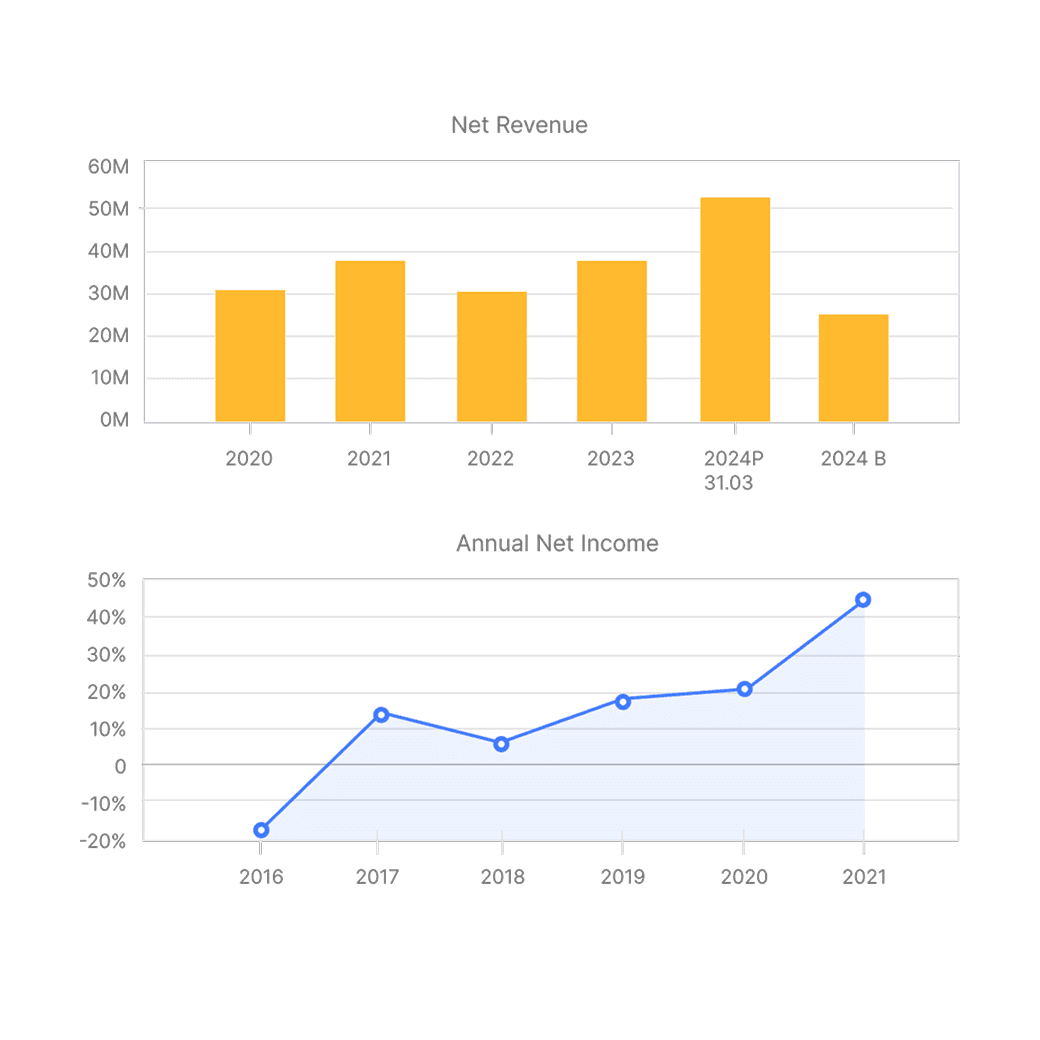

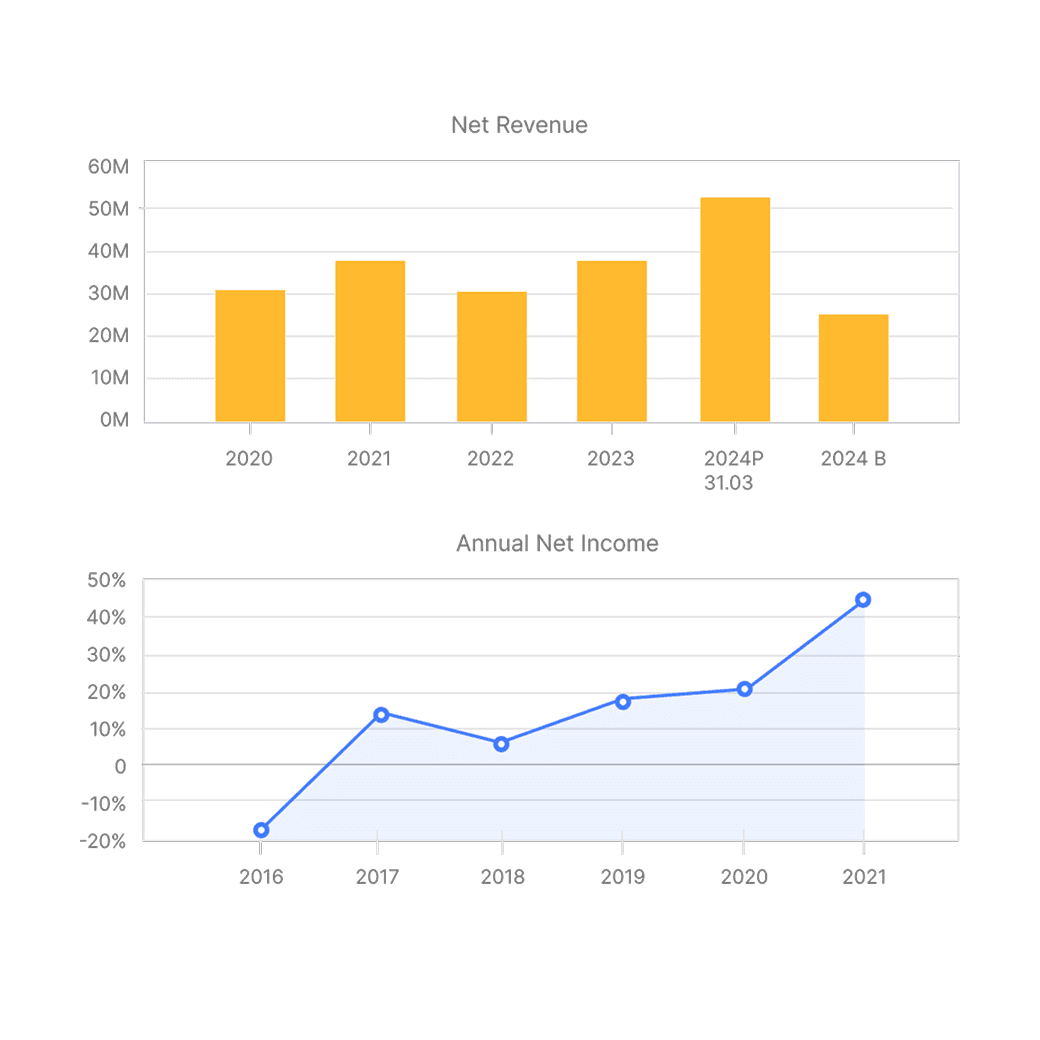

Commercial liquidity module

360 degree overview ready when you need it

All relevant data is gathered and presented to the advisor in a structured and flexible manner

Commercial liquidity module

360 degree overview ready when you need it

All relevant data is gathered and presented to the advisor in a structured and flexible manner

Commercial liquidity module

360 degree overview ready when you need it

All relevant data is gathered and presented to the advisor in a structured and flexible manner

Analyse company structure, financial statements and key figures to build a complete financial overview

Assess serviceability, liquidity and risk through scenario modelling and industry benchmarking

Forecast and analyse performance and investment scenarios, including industry-specific projections (such as real estate)

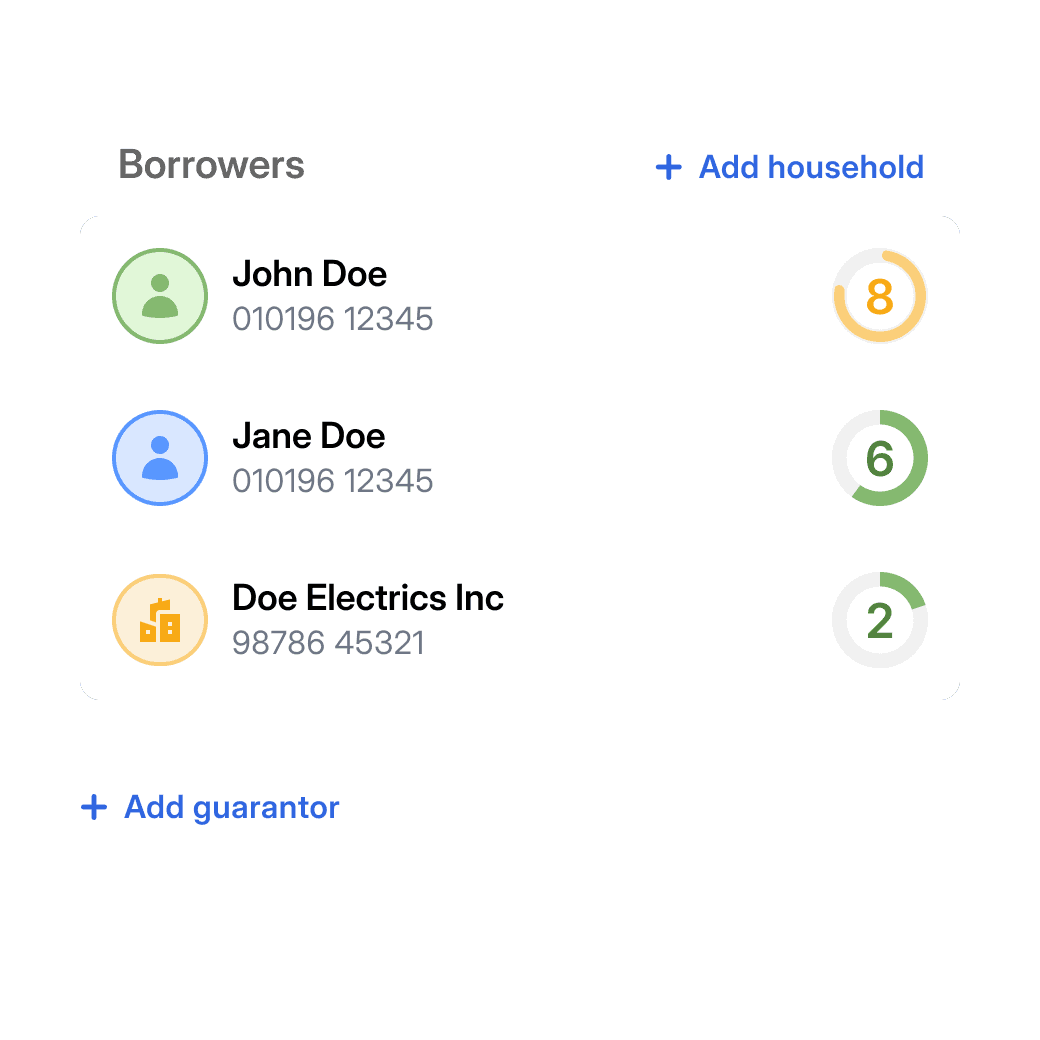

Market-leading collaterals module

Collateral analysis and handling made easy

Comprehensive, intuitive and intelligent

Market-leading collaterals module

Collateral analysis and handling made easy

Comprehensive, intuitive and intelligent

Market-leading collaterals module

Collateral analysis and handling made easy

Comprehensive, intuitive and intelligent

Covers close to all relevant collateral objects and stakeholders in the Nordic markets, with ready-made judicial registration for more than 30 types of pledges

Provides intuitive and efficient handling with embedded intelligence even for large cases, such as identification of available collateral

Supports next-generation credit optimalisation with extensive collateral metadata

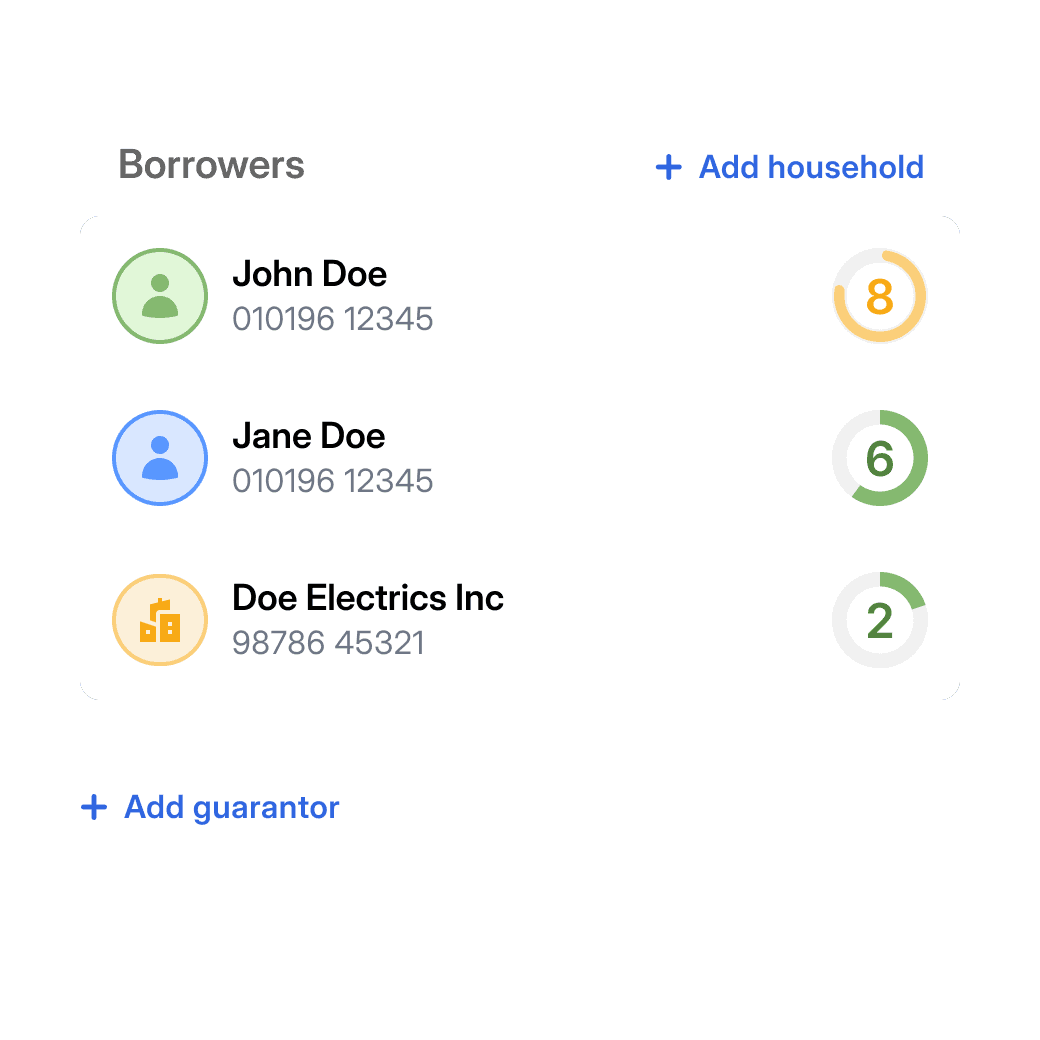

Sole proprietorships module

Integrated analysis of business and personal finances

Gain the complete picture of the case

Sole proprietorships module

Integrated analysis of business and personal finances

Gain the complete picture of the case

Sole proprietorships module

Integrated analysis of business and personal finances

Gain the complete picture of the case

Add both the company and the proprietor to the case

Analyse the financial situation of both the company and the household

And see the complete engagement across the individual and the company

Credit process platform

World-class, credit-native origination

We have everything you need to streamline SMB credit origination.

Credit process platform

World-class, credit-native origination

We have everything you need to streamline SMB credit origination.

Credit process platform

World-class, credit-native origination

We have everything you need to streamline SMB credit origination.

Decision Engine Editor

Decision Engine Simulator

Embedded AI

Credit Process Tool

Enable real-time credit decisions aligned with your own business and policy rules across multiple parameters, specific to various countries and segments, with Stacc's Gartner® recognised Credit Decision Engine.

Edit rules with complete version history and audit trail. Plug in any AI model or inputs as part of the decision process.

Conduct A/B tests with your decision rules to optimise performance and drive better outcomes.

Decision Engine Editor

Decision Engine Simulator

Embedded AI

Credit Process Tool

Enable real-time credit decisions aligned with your own business and policy rules across multiple parameters, specific to various countries and segments, with Stacc's Gartner® recognised Credit Decision Engine.

Edit rules with complete version history and audit trail. Plug in any AI model or inputs as part of the decision process.

Conduct A/B tests with your decision rules to optimise performance and drive better outcomes.

Decision Engine Editor

Decision Engine Simulator

Embedded AI

Credit Process Tool

Enable real-time credit decisions aligned with your own business and policy rules across multiple parameters, specific to various countries and segments, with Stacc's Gartner® recognised Credit Decision Engine.

Edit rules with complete version history and audit trail. Plug in any AI model or inputs as part of the decision process.

Conduct A/B tests with your decision rules to optimise performance and drive better outcomes.

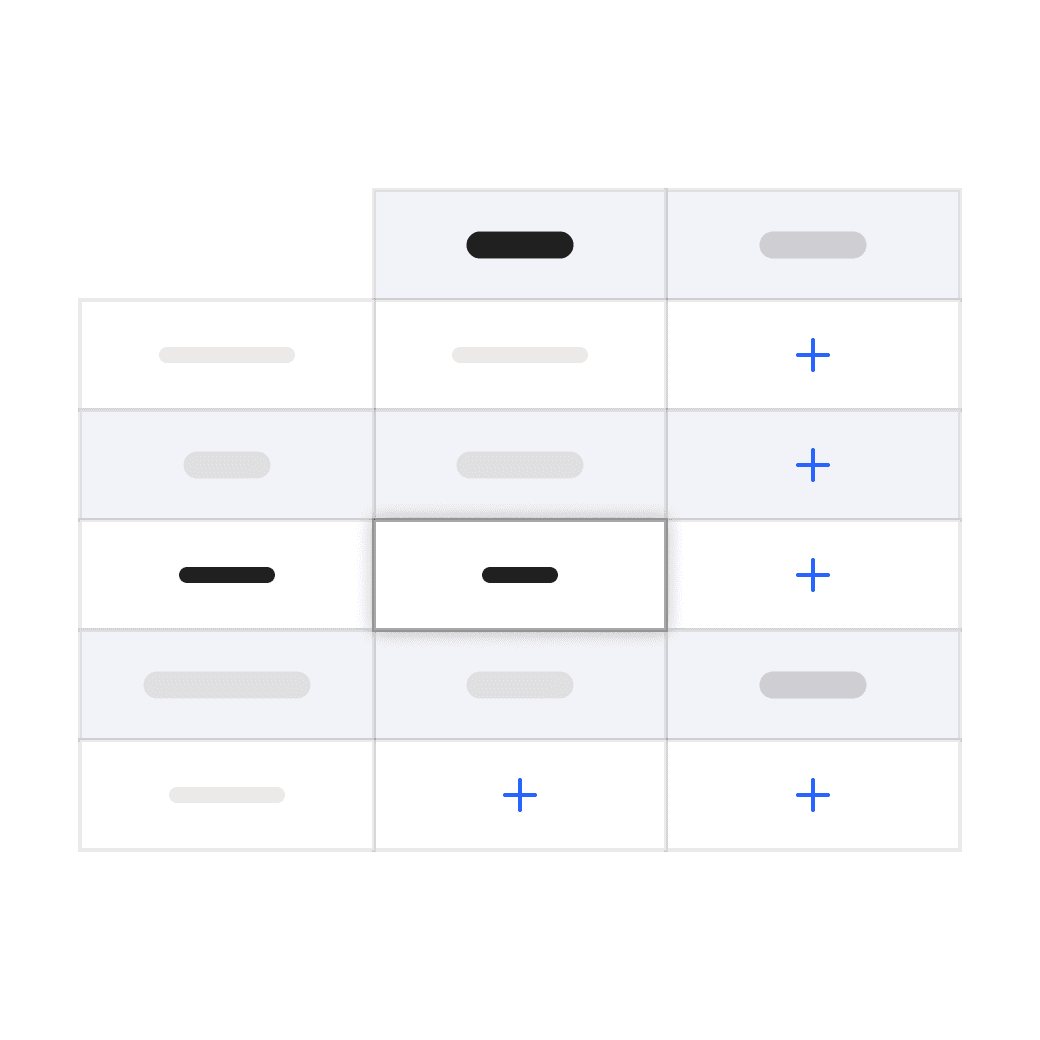

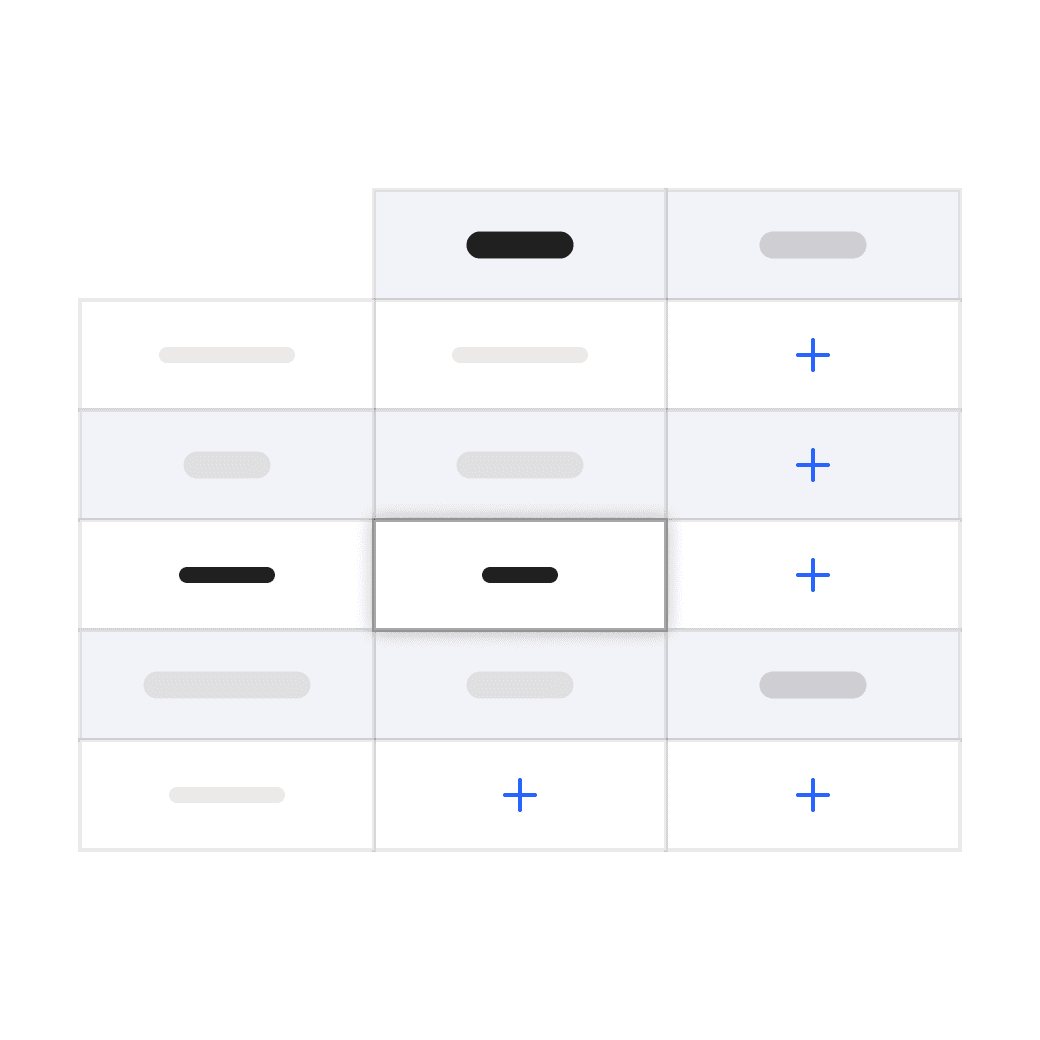

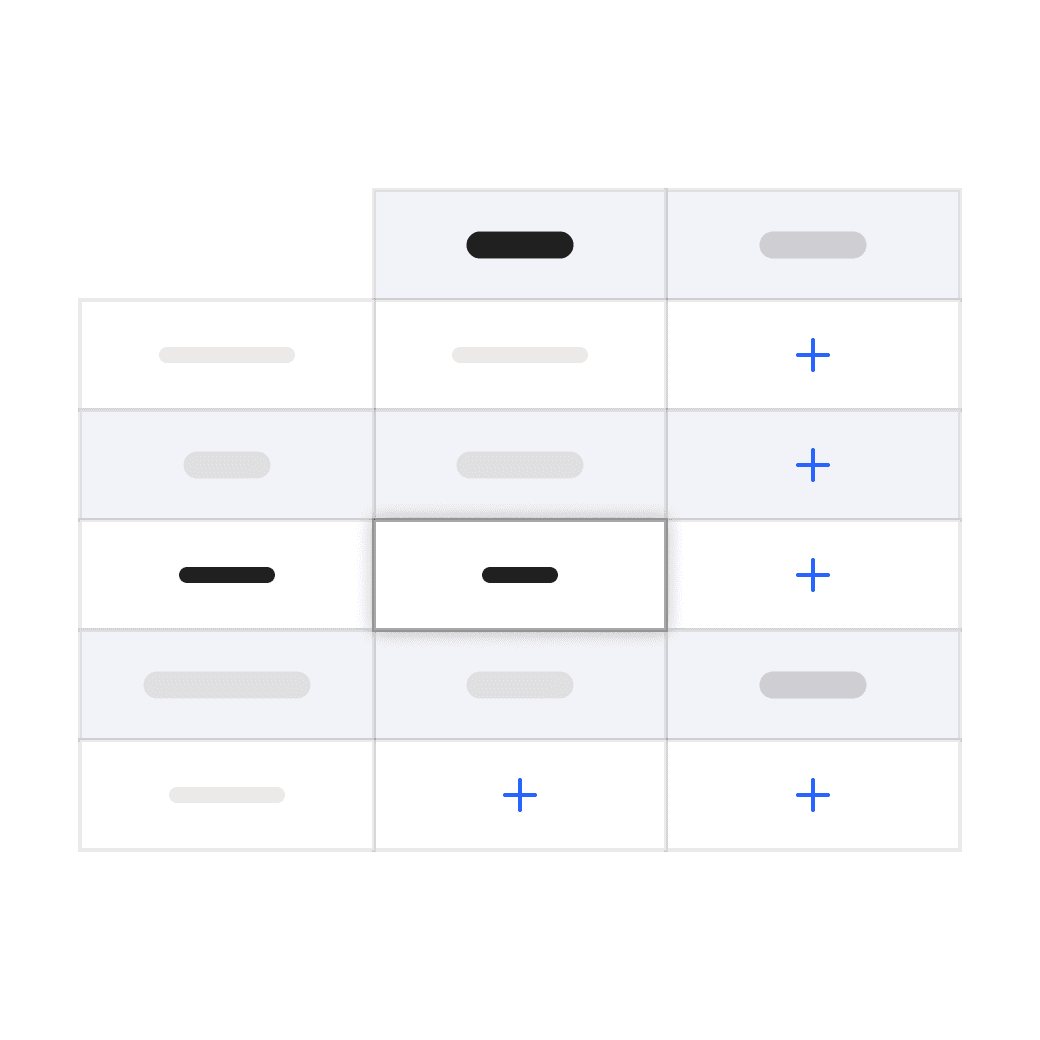

Composable SMB lending software

Compose your own SMB lending solution with 1, 2 or 3 products

Each product in Stacc SMB Lending is API-native and can be delivered standalone or in combination to compose your own SMB lending solution.

Composable SMB lending software

Compose your own SMB lending solution with 1, 2 or 3 products

Each product in Stacc SMB Lending is API-native and can be delivered standalone or in combination to compose your own SMB lending solution.

Composable SMB lending software

Compose your own SMB lending solution with 1, 2 or 3 products

Each product in Stacc SMB Lending is API-native and can be delivered standalone or in combination to compose your own SMB lending solution.

Loan origination

Loan servicing

Front-end agnostic

Channel-agnostic journeys and support for all channels

Provide SMB lending applicants the comfort of starting an application in any channel - and complete it any channel.

Front-end agnostic

Channel-agnostic journeys and support for all channels

Provide SMB lending applicants the comfort of starting an application in any channel - and complete it any channel.

Front-end agnostic

Channel-agnostic journeys and support for all channels

Provide SMB lending applicants the comfort of starting an application in any channel - and complete it any channel.

Customer application

Best-practice starting point for a user-friendly SMB lending application

eID

eID

eID

e-Signatures

e-Signatures

e-Signatures

Data & documentation

Data & documentation

Data & documentation

KYC/KYB & AML checks

KYC/KYB & AML checks

KYC/KYB & AML checks

Credit scoring

Credit scoring

Credit scoring

MyPage

A self-service portal where customers can track or manage their application or current loan

Track application status

Track application status

Track application status

Request refinancing

Request refinancing

Request refinancing

Request interest-only period or payment holiday

Request interest-only period or payment holiday

Request interest-only period or payment holiday

Make additional payments

Make additional payments

Make additional payments

Change due date

Change due date

Change due date

Touchpoints

Additional touchpoints to support customer connection

Customer chat

Customer chat

Customer chat

SMS/E-mail notification

SMS/E-mail notification

SMS/E-mail notification

Automated reminders

Automated reminders

Automated reminders

API integrations with 3rd party platforms

API integrations with 3rd party platforms

API integrations with 3rd party platforms

Explore related solutions for SMB lenders

Research & perspectives

Request a Demo

Ready to transform your SMB lending institution?

Experience the modern, highly automated and intelligent value of Stacc SMB Lending

Request a Demo

Ready to transform your SMB lending institution?

Experience the modern, highly automated and intelligent value of Stacc SMB Lending

Request a Demo

Ready to transform your SMB lending institution?

Experience the modern, highly automated and intelligent value of Stacc SMB Lending

Disclaimer: GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Disclaimer: GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Disclaimer: GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Why Stacc

Who we serve

Customer journey

Solutions

Products

Credit process platform

Core credit ledger

Affordability and collaterals engine

Liquidity and collaterals engine

Asset finance quote engine

Asset delivery engine

Invoice lifecycle management

Treasury and portfolio platform

Client lifecycle management platform

©️ 2026 Stacc AS, All rights reserved.

Why Stacc

Who we serve

Customer journey

Solutions

Products

Credit process platform

Core credit ledger

Affordability and collaterals engine

Liquidity and collaterals engine

Asset finance quote engine

Asset delivery engine

Invoice lifecycle management

Treasury and portfolio platform

Client lifecycle management platform

©️ 2026 Stacc AS, All rights reserved.

Why Stacc

Who we serve

Customer journey

Solutions

Products

Credit process platform

Core credit ledger

Affordability and collaterals engine

Liquidity and collaterals engine

Asset finance quote engine

Asset delivery engine

Invoice lifecycle management

Treasury and portfolio platform

Client lifecycle management platform

©️ 2026 Stacc AS, All rights reserved.