Stacc Mortgage Origination modules are trusted by 70+ banks and 2,000+ advisors

Mortgage simplicity and flexibility

Proven business impact delivered with Stacc Mortgage Origination

Win more high-quality mortgage applications.

In less time. At lower cost.

All of this while enabling 100% compliance and limitless innovation

Why Stacc Mortgage Origination?

World-class Mortgage origination software

Any mortgage products and processes

Any interest rate

Any collaterals

Any borrower

Security and compliance you can trust

SOC 2© Type 2 attestation report available and ISO 27001 certified

GDPR, NIS 2, DORA, EU AI Act, financial and ICT regulations

Custom instance with time-sensitive reporting plus extensive logging and audits

DevSecOps & CI/CD pipeline security, GRC platform, pen testing and continuous policy & risk monitoring

Scalable and flexible platform

Cloud- and API-native platform built for scale to any size

Supports 3M+ credit applications/year and 1,500+ concurrent users per installation with existing customers

Multi-country, multi-currency, multi-asset and multi-credit type

Integration-friendly and fully agnostic

Extensive service catalogue of 200+ pre-built integrations

Core, cloud and data agnostic, built for fast time-to-market

Self-serve, low-code/no-code configuration, tools and workflows

Proven reliability

40+ years of domain experience

280+ customers, including Nordic Tier 1 banks

ISO 9001 certified quality management

24/7/365 SLA-backed SaaS delivery with 99.95% uptime guarantees available

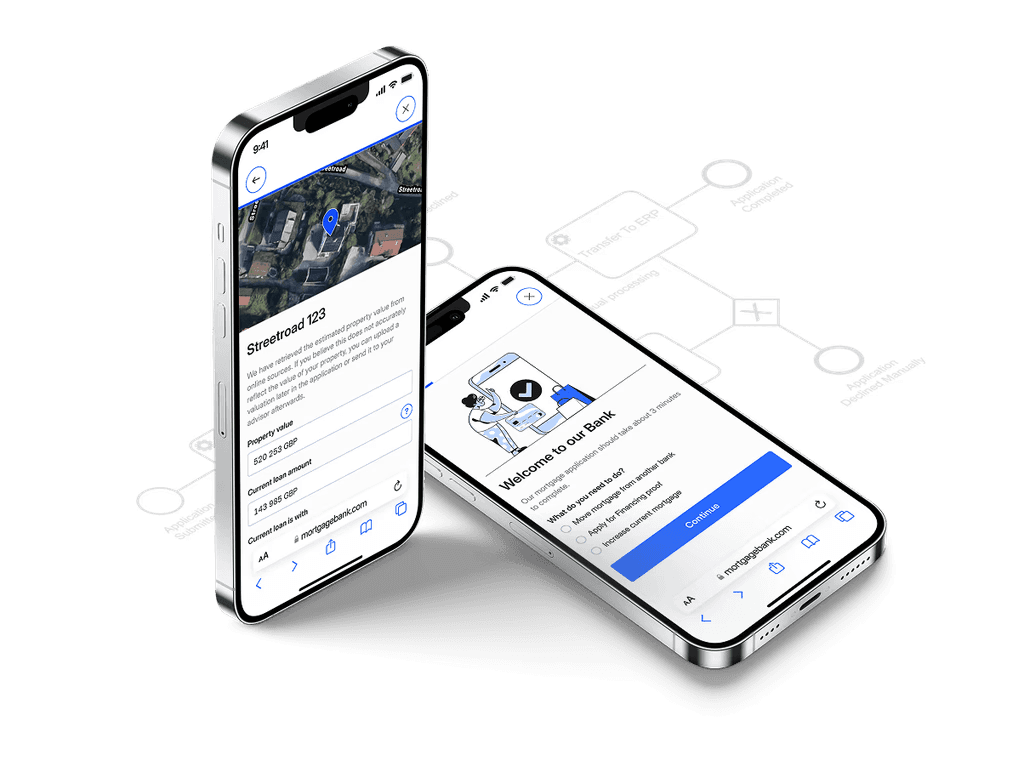

Customer application

Best-practice starting point for a user-friendly mortgage application.

MyPage

A self-service portal where customers can track manage their application.

Touchpoints

Additional touchpoints to support customer connection.

Customer journey mapping

Process specification

Mapping of integrations

Scope & implementation plan

Proof of value

Setup custom cloud instances

Software installation and configuration

Integrations establishment

Training of super users

Testing and acceptance

Rollout of the new solution

We ensure flawless and transparent operations

Hypercare monitoring

Daily operations with Stacc support

Continuous maintenance services and technical upgrades

Bringing you modern innovations at your own pace

The information provided by Stacc Mortgage Orgination Benefits Calculator is an estimate for general informational purposes only, provided in good faith. Stacc does not guarantee results.

Research & perspectives

FAQ

Disclaimer: GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.