Stacc Debt Collection

From scattered systems to seamless collections

Stacc Debt Collection connects systems, data, and workflows into one platform for modern debt collection – so you can focus (less on systems and more) on your value-adding services.

Low levels of efficiency and automation

Limited ability to change the status quo

100%

increase in debt collection claims over the last 10 years in Sweden

Svensk Inkasso, 2024

11.7%

increase in the number of debt collection cases in Norway

increase in the number of debt collection cases in Norway

24.3%

increase in the number of insolvency proceedings in Germany

increase in the number of insolvency proceedings in Germany

60%

of European SMBs reported challenges in managing late payments in 2022

of European SMBs reported challenges in managing late payments in 2022

40%

of SMBs struggle to recover debts manually

of SMBs struggle to recover debts manually

All of this while enabling 100% compliance and limitless innovation

Standard configurations

Invoice administration

Debt Collection

Factoring

Intuitive front-ends

Modern and user-centric

API-native, standard modules with extensive composability for all steps in an invoice lifecycle

Financing

Ledger

Invoice admin

Clients

Customers

Pricelist

Case import

Case handling

Interest calculation

Debt tracking

Payment matching

Scoring engine

Disbursements

Bank accounts

Import

Distribution

Templating

Accounting data

Accounting export

Reconciliation

Key features

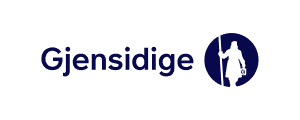

Adaptable and automated debt collection

We have everything you need to streamline invoice administration and debt collection

Scalability

Enhanced capacity where it’s needed most

Our modular architecture solution directs resources to areas where they are most needed, helping improve efficiency and uptime.

Functionality scaling

Add new features and business logic aligning with diverse customer or business processes.

Geographic enabler

Enables support for regional settings on rules, processes and regulations. Adapt to new markets effortlessly.

Real-time operations

Stacc Debt Collection operates as a real-time event-based solution. Triggered events initiate configured workflows, each running independently without unnecessary dependencies.

Adaptability

Cross-border compliance-enabler

Stacc Debt Collection can be adapted to meet the regulatory requirements of the country in which you operate. With extensive configuration options, achieve seamless compliance and navigate complex legal landscapes for smooth cross-border operations.

Manage revenue-sharing

Manage business agreements with Stacc Debt Collection’s advanced revenue-sharing functionality. Simplify everything from agreement setup to accounting exports with intuitive tools.

Dynamic currency management

Manage multiple currencies effortlessly with real-time matching, conversion and integration into your workflows—all within a single instance. Streamline financial management across borders with ease.

Flexible installment plans

Adjust terms, modify monthly payments, choose amortisation types, pause payments or add fees. Stacc Debt Collection’s flexibility lets you fine-tune repayment plans to your business and customer needs.

Automation

Fully automated workflows

From invoices to payments, every stage runs seamlessl.

Trustworthy workflow processing

Invoices and cases are automatically processed according to your configured rules

Effective resource utilisation

Reduce manual work and focus on high-value tasks

Proactive exception handling

Receive alerts only for critical issues, with solutions ready to implement

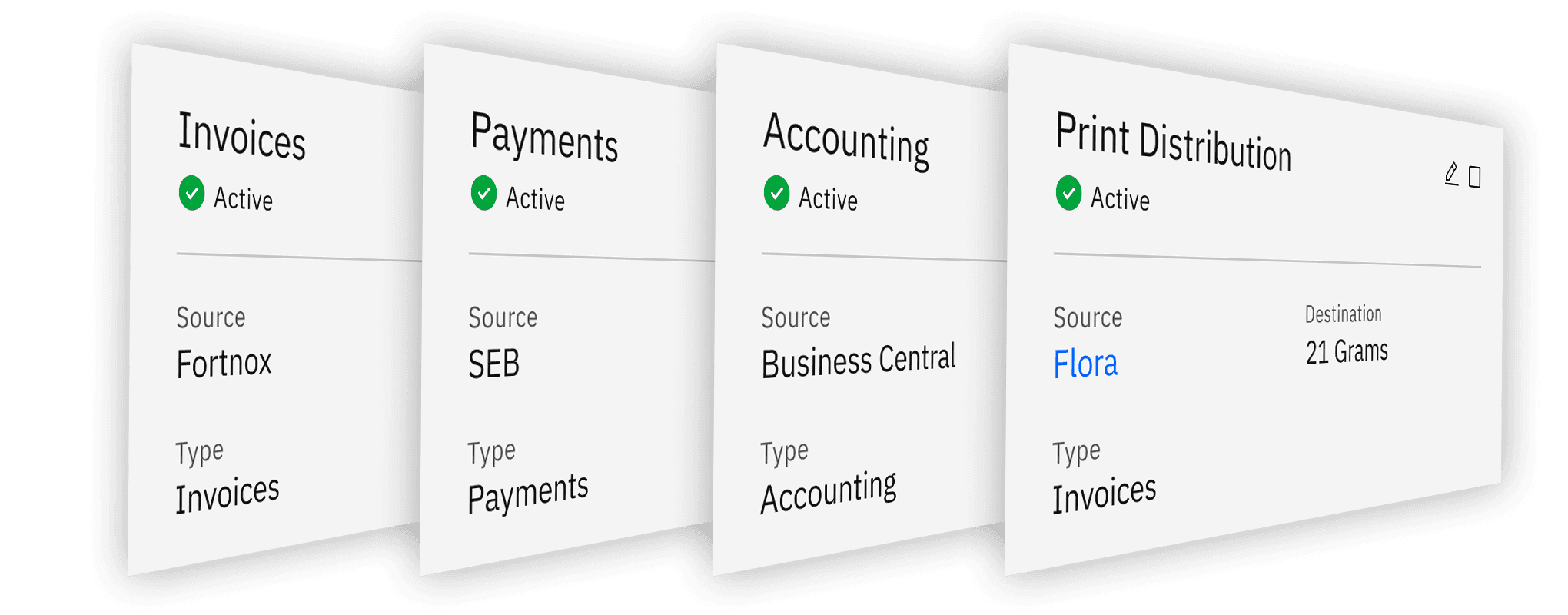

Connectivity

Advanced API Integration

Import and export data with ease, maintaining complete control of your processes.

Support for existing applications

Enables use of old beloved code, solutions & integrations minimizing your efforts towards integrations with Flora.

Focus on growth

Our open and integrable solution allows you to shift focus from basic operations to driving innovation and investing in R&D, enabling growth and competitive advantages.